Mr. Robinson’s Honors Accounting II class isn’t one of those high school courses that puts students to sleep.

In fact, it’s waking up the Dallastown community.

For the past two years, students have been helping residents file taxes—free of charge through the Volunteer Income Tax Assistance program (VITA).

The class initially focused on corporate financial statements, depreciation, analysis, and merchandising in business. However, over the past two years, the program has evolved, giving students the opportunity to earn tax certification through the IRS.

“I worked with Dr. Wilson (DHS principal) to get approval because we were bringing in community members who weren’t directly connected to the school. Thankfully, everyone has been supportive of the program,” Robinson said.

Once approved, the next step was to advertise the program to the Dallastown community.

“We put together a flyer and shared it on social media, but most of our recruitment comes from the IRS website. We have a site ID number, so when people search for VITA sites, Dallastown High School appears. This year, we also partnered with the United Way of York, which helped with advertising. and conducting quality reviews. With their help, we quickly filed over 50 appointment time slots,” Robinson explained.

Once the program was certified by the IRS, Dr. Wilson gave the green light, and the class became an official IRS site. Students then had t

he opportunity to become certified in either basic or advanced tax preparation.

Throughout the Honors Accounting II curriculum, students practice filing taxes, with a focus on corporate accounting, financial analysis, payroll, taxes, and ethical decision-making.

“We sit down and go through sample tax forms and returns—almost like practice cases. There’s a practice lab where we use tax software called TaxSlayer to experiment with different scenarios,” Robinson said.

He’s been impressed with the students’ preparation and ability.

“What I’ve noticed in year two is that students become very competent with federal returns, understanding the forms and how to complete them. However, I want to give them more practice with state and local returns, including things like rent rebates and property tax rebates,” Robinson said.

As the site coordinator, Robinson and Mr. Donatelli review each return to ensure accuracy before finalizing any tax filings.

Senior student Lavann Diehl is no stranger to the program. She’s the most experienced student in the class, having participated from the start. Diehl has learned valuable lessons through this hands-on experience.

“One benefit of taking Accounting II is that you can apply what you learn to your personal life—like filing taxes, tracking spending, and identifying ways to save money. The course also teaches essential skills like problem-solving, organization, and business ethics—skills that are useful in any career,” Diehl said.

She says it is especially helpful for future entrepreneurs who need to understand the financial side of their business.

“A highlight of the class is the hands-on experience through the VITA program. You learn to work with real tax forms using TaxSlayer while helping others. This experience has also improved my communication skills. Talking with taxpayers not only helped me understand their financial needs, but it also made them feel more comfortable. I realized how important strong communication and relationship-building are to creating a welcoming environment,” Diehl said.

While teachers and students often have different opinions and passions about a class, Diehl shares a strong passion for what this program offers. Additionally, each student can earn three college credits through Carlow University for their contributions to the program.

When asked about her future plans, Diehl shared how she intends to apply what she’s learned in Honors Accounting II to her next steps beyond high school.

“I enjoy filing taxes because it helps people in our community who might not afford paid services. It also gave me hands-on experience I wouldn’t get in a classroom. I’m going into accounting and will be majoring in it at York College. After taking Accounting I and II with Mr. Robinson, I realized it’s something I’m good at and enjoy,” Diehl said.

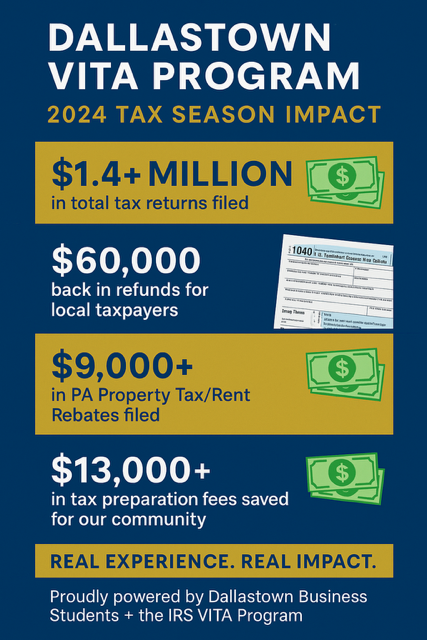

This year the Dallastown VITA program filed over $1.4 million in total tax returns resulting in $60,000 back in refunds for local taxpayers. They also saved the local community over $13,000 in tax preparation fees.

Robinson has hopes to grow this program and is excited to see what the future holds.

Sally Cash • May 14, 2025 at 3:39 pm

My husband and I had our taxes completed by Mr. Robinson’s students and what a great job they did. It was nice to see the students involved and they were a pleasure to talk to. Thank you Mr. Robinson, what a great program for the elderly in the Dallastown community.